Featured

- Get link

- X

- Other Apps

Dividend Tax Credit Calculator

Dividend Tax Credit Calculator. Return to company tax rates page. With the use of our dividend tax calculator, you are able to discover how much income tax you will be paying with the input of your current salary and the annual dividend payments that you make.

Find out your tax brackets and how much federal and provincial taxes you will pay. This gives you a total income of £32,570. To use our calculator, simply:

Dividend Tax Credits Are Claimed On Your Personal Income Tax Returns.

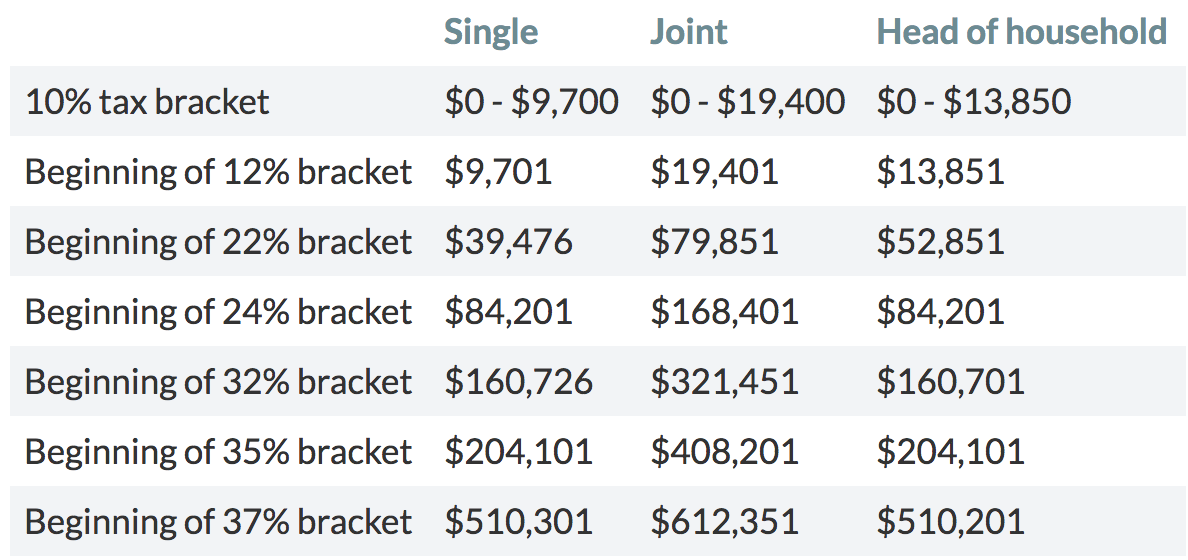

Apply the dividend tax rates according to the table below: So for a grossed up amount of $690, the tax credit is $103.64 (15.0198% of $690). How to calculate franking credits.

If Your Income Is Greater Than £100,000, Your Personal Allowance Benefit Is Cut By £1 For Every £2 You Earn Above The Threshold.

The income brackets for them are generally adjusted each. To use our calculator, simply: The calculator will also display the average tax rate and marginal tax rate.

Calculations Are Based On Rates Known As Of December 21, 2021.

Enter the total amount of your salary which has been put. The amount a canadian resident applies against their tax owing on the grossed up portion of dividends received from canadian corporations. So, at a personal income level of £125,140, your entire personal allowance would have been removed.

If Income Is Moved From Other Income To Canadian Dividends, Total Taxes Will Be Reduced Even As The Oas Clawback Increases.

Taxtips.ca investment income tax calculator. Work out the taxable income portion of the dividend by subtracting the salary, which for most contractors will be £7,956, and other income; A company with an imputation tax rate of 27.50% wanting to use tax credits of $1,896.53 would pay a dividend of $10,000.02 if franked to 50.00%.

The Franking Credits On Your Dividends Can Be Calculated Using This Formula:

The dividend tax rates for 2020/21 tax year remain as the previous year, i.e. You will report the total federal credit amount in. This gives you a total income of £32,570.

Popular Posts

Standard Costs Are Used In The Calculation Of

- Get link

- X

- Other Apps

Comments

Post a Comment