Featured

- Get link

- X

- Other Apps

Nhs Pension Calculator 2015 Examples

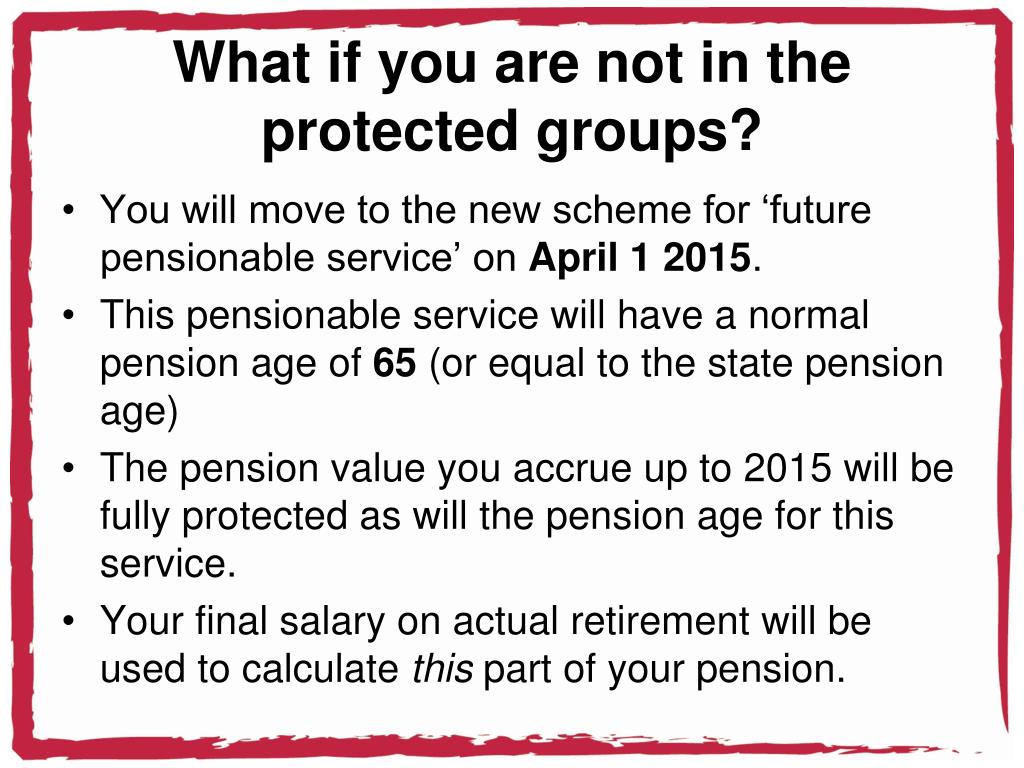

Nhs Pension Calculator 2015 Examples. The early retirement calculator shows what to expect if you claim benefits earlier than normal pension age. In the example compound revaluation of the £333 at 3.5% for 19 years equals the £640 stated in the example.

Our web page can be used to compare how the amount of pensions received in retirement is calculated in each section of the nhs pension scheme. I spent half an hour on the nhs pensions website and couldn't find anything. Calculating your 2015 nhs pension:

In The Example Compound Revaluation Of The £333 At 3.5% For 19 Years Equals The £640 Stated In The Example.

You will build up 1/54 th of your pensionable pay in a year. Thanks again for replying so quickly, Although that example isn't contractual it confirms the intent is compound revaluation.

In The 2015 Scheme The Build Up Rate Is 1/54Th, So You Earn A Pension Each Year Of 1/54Th Of Your Pensionable Earnings.

In other words, each year of membership of the scheme nets you a pension worth 1/54 th of your pensionable earnings that year. In the 1995 section only, the total pensionable pay (tpp) figure is the best of the last three years notional whole time pensionable pay prior to a members retirement. The revaluation rate is determined by treasury orders plus 1.5% each year.

For Hospital Doctors And Dentists (Also Known As Officers), The 1995 And 2008 Sections Predominantly Pay A Final Salary Pension, Whereas The 2015 Scheme Is A Career Average (Care) Scheme.

The calculation is as follows: There are also calculators for estimating the cost of purchasing additional pension and for working out how much pension you'll have to sacrifice if you want to take a lump sum at retirement. The calculator will not estimate 1995 section benefits for members aged 50 to 55.

The Provision Is Only Applicable To Members Of The 1995 Section Whose Employment Is Terminated On Or Before 31 March 2016 And Who Are Accepted For A Tier 2 Ill Health Pension As It Was Part Of The Transitional Arrangements Agreed During Consultation With The Department Of Health And Social Care, Nhs Pensions, Nhs Employers And Nhs Trade Unions.

Pension growth (or the pension input amount) is determined by first calculating the opening and closing values of your nhs pensions benefits in the pension input period (which is the same as the tax year, 6 april to 5 april). If you are in a single scheme, the calculations are fairly. This is then divided by the scheme type, for example 80ths.

The Much Anticipated 2015 Scheme Guide And Calculator Guide Have Been Published Today.

Nhs pension calculator online provides its misleading information online, we do our best to try and study out the competition for nhs pension calculator. A member earning £50,000 each year from age 25 to 64 would get a pension from age 64 worth £39,000 per annum for life. This figure is used to calculate a 1995 section member's pension benefits.

Popular Posts

Standard Costs Are Used In The Calculation Of

- Get link

- X

- Other Apps

Comments

Post a Comment